Guidance

Guidance

Access to and disclosure of an incapacitated person's will

Access to and disclosure of an incapacitated person's will

Updated 25 November 2019 (Date first published: 13 March 2017)

Status

This guidance is to help you understand your obligations and how to comply with them. We may have regard to it when exercising our regulatory functions.

This guidance may also be used by other organisations including the Court of Protection, Office of the Public Guardian, Legal Ombudsman, the Law Society and the Society of Trust and Estate Practitioners.

Who is this guidance for?

All authorised firms and their employees.

Purpose of this guidance

To clarify circumstances where a solicitor can disclose a copy of a client's will to a property and financial affairs attorney or, in circumstances where the client has lost mental capacity, to a deputy appointed by the Court of Protection.

Who is your client?

A solicitor can accept instructions given by someone else, where the person providing the instructions has the authority to do so on behalf of the client.

Where the client (also known as 'the donor') has made a power of attorney, they remain the client by acting through their agent – which will be the person(s) appointed as their attorney.

Similarly a deputy appointed by the Court of Protection will be a statutory agent for a person who lacks mental capacity and who they are acting for (see section 19 of the Mental Capacity Act 2005).

Whether instructions come from an attorney or a deputy, the solicitor's duty of care is always to the client, the person they are acting for.

Duties of an attorney or a deputy

The Court of Protection has made it clear that attorneys and deputies owe a duty when they are making financial decisions to not interfere with succession plans made by the person they are acting for, as far as reasonably possible (see Attorney-General v The Marquis of Ailesbury (1887) App Cas 672; Re Joan Treadwell). Understanding the contents of their will and/or codicils(s) means that the attorney or deputy can act in the best interests of that person.

In particular this means that an attorney or a deputy can:

- take and act upon appropriate professional advice;

- make appropriate investments;

- apply to the Court for an order to save a specific legacy (so far as possible) where disposal of the asset is required;

- apply to the Court for a statutory will to ensure that it reflects the intentions of the person who lacks mental capacity and the relevant circumstances; and

- arrange for safekeeping and storage of assets.

Examples of problems that could occur if a deputy or attorney is unaware about the contents of the will

Jack's case

Jack made a will giving his house (currently worth £300,000) to his nephew, Paul, and the residue of his estate (about £20,000) to charity. He also made a Property and Financial Affairs Lasting Power of Attorney, without any restrictions in favour of Paul, and registered this with the Office of the Public Guardian.

Jack recently had a stroke and cannot continue to live in his own home. Paul has decided that he will have to sell the house to pay for Jack's care.

The effect of selling the house is that when Jack dies the gift in the will fails and Paul will get nothing, while the charity benefits from the whole of the estate. This was not what Jack intended.

However, if Paul is aware of the contents of Jack's will he can apply to the Court of Protection for either a statutory will to be made so that Jack's wishes are followed, or he could obtain an order for sale, which in accordance with Schedule 2 (paragraphs 8 and 9) of the Mental Capacity Act 2005 ensures that the gift is saved.

June's case

June's will includes her wish to give her premium bonds to her friend Margaret. They were worth £500 at the time the will was prepared. June's son David is the sole residuary beneficiary and is unaware of the contents of the will.

June has dementia and lacks mental capacity to manage her finances. David has been appointed as June's deputy, and has decided to invest £49,500 of June's money in premium bonds.

June recently died and David has discovered that her will means that Margaret will now get £50,000 premium bonds - much more than his mother intended.

Had David been aware of the will he could have invested his mother's money differently and avoided frustrating June's succession plans.

Recording your client's instructions when their will and lasting power of attorney are made

Solicitors must act in the best interests of each of their clients (Principle 7). The will forms part of the donor's financial affairs, so their attorney is entitled to a copy of this unless the donor has provided instructions to the contrary. It is advisable to discuss this possible disclosure with the donor at the time of making the will, so that the donor's position towards disclosure can be recorded and then confirmed at the time of making any lasting power of attorney (LPA).

You should make sure your client is advised about the consequences of any LPA and instructions should be obtained in terms of any circumstances they agree to when disclosure of their will is to be permitted or is to be refused. This should be incorporated into the LPA or contained in a side letter. For more information see the Law Society's LPA guidance

Managing client instructions for non- disclosure of their will

A client's will should not be disclosed if they are clear that they do not wish that to happen prior to their death. However if a court order is obtained that requires disclosure of your client's will, you must comply with the court order and disclose the will.

If you believe disclosure of your client's will is not in their best interests you will need to seek a variation of the court order by submitting a witness statement to the Court of Protection to explain why the will should not be disclosed. In such circumstances you may ask the Court of Protection for authority for your costs to be paid from the client's estate.

Incapacity restrictions

LPAs or Enduring Power of Attorneys (EPAs) may contain a restriction to prevent an attorney from acting until the donor lacks mental capacity to manage his or her property and financial affairs. In such situations you are advised to require the attorney to provide sufficient evidence that they now have authority to act under the power.

Attorneys must register EPAs with the Office of the Public Guardian. When an attorney believes the donor is becoming (or has already become) unable to manage their property and financial affairs, the registered EPA is sufficient evidence of the donor's mental incapacity. However, for registered LPAs, this assumption cannot be made as registration itself does not indicate incapacity. For these reasons the attorney will need to provide sufficient evidence to confirm that the donor lacks the required capacity to consent to the disclosure of the will.

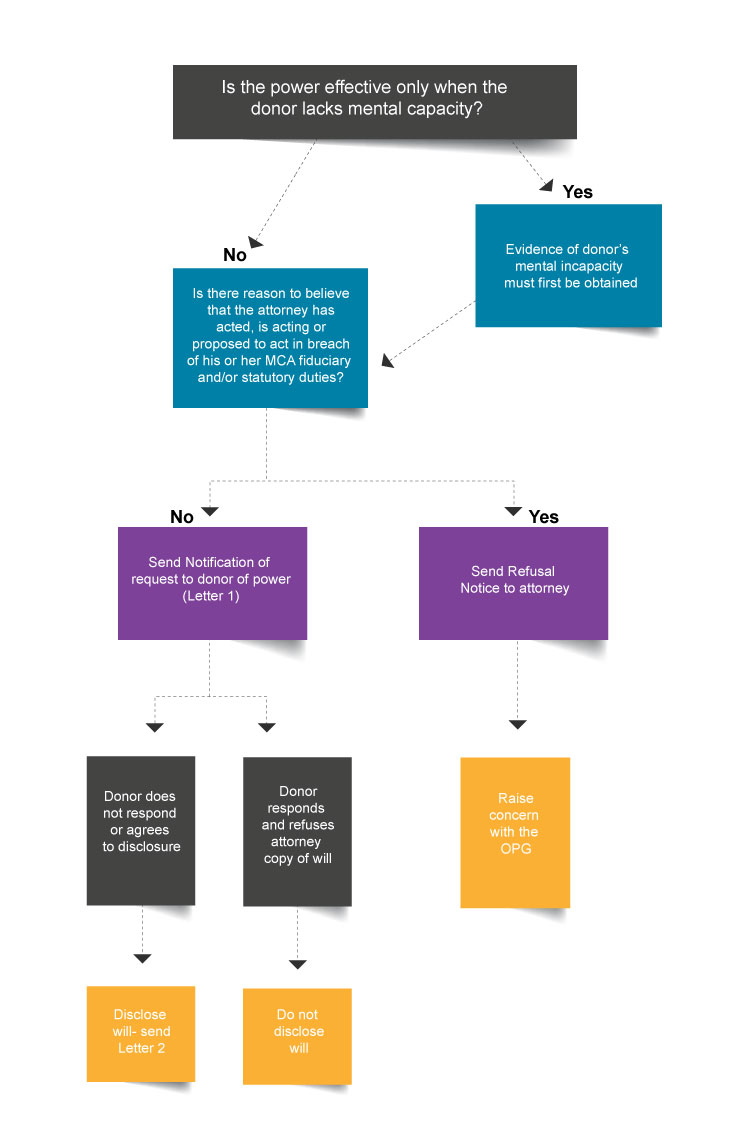

In the 'Other Resources' section at the end of this guidance page there is a flow chart that helps to explain and map this process out.

Remember that the will is the client's property

A property and financial affairs attorney, or a deputy, is your client's agent and the client's will forms part of the property and financial affairs which the agent is authorised to manage. This means that if there is no instruction to the contrary within the LPA, EPA or in a Court order, a full copy of the will can be disclosed to the attorney or deputy unless you have cause for concern (see the next section). You should retain the original will as part of your client's papers and in accordance with the original client agreement, unless you are ordered otherwise by the Court of Protection.

Concerns about an attorney or deputy

There may be occasions where you become aware of or have reason to believe that an attorney or deputy has acted, is acting or proposes to act in breach of their statutory and/or fiduciary duties. These duties are explained in Chapter 7 of the Mental Capacity Act 2005's Code of Practice.

An example of this is where a solicitor has credible information which gives cause for reasonable concern that, if the client's will is disclosed, there is a reasonable belief that the attorney or deputy may act or make a decision which is not in the best interests of the person they are acting for. In such circumstances the solicitor may consider that it is not appropriate for the will to be disclosed as it is not in the client's best interests to do so.

If such a situation arises, you can find in the 'Other Resources' section at the end of this guidance page,a template headed 'Refusal Notice for disclosure of a will' which can be sent to the attorney or deputy . At the same time the solicitor should contact the Office of the Public Guardian and inform them of their concerns. Any concern that is raised with the Office of the Public Guardian will require disclosure of confidential information and would be justified from a professional conduct perspective. Paragraph 7.7 of the Code of Conduct for solicitors, RELs and RFLs would require you to make such a report where you have serious concerns regarding the conduct of an attorney or deputy.

Some examples of other concerns which would be worth reporting to the Office of the Public Guardian include (but are not limited to):

- a situation where an attorney or deputy wishes to transfer or has already transferred the client's assets to themselves or someone who is related or connected to them;

- there is an indication that a client's assets are either missing or have been converted,;

- an attorney or deputy has had an unexpected change in lifestyle or personal circumstances;

- a client's care fees are not being paid;

- an investigation into and / or an application for the attorney's or deputy's removal is in the process of being made;

Notification of disclosure to the donor

If you are proceeding with a will disclosure request, it is courteous and good practice to let the donor know that their attorney has requested a copy of the will and that you intend to provide it to them. You should let them know in advance of sending the will to the attorney.

Letter 1 in the 'Other resources' section at the end of this guidance page should be sent to the donor, regardless whether or not the donor has mental capacity. The attorney should also personally inform the donor that they have requested a copy of the will.

Letter 2 in the 'Other resources' section at the end of this guidance page can be used as a covering letter for sending the will to the attorney.

Notification of disclosure to 'P' by the deputy

The Court of Protection appoints a deputy to make property and financial affairs decisions on a continuing basis, the wide terms of which enable a deputy to see a copy of the will of the person for whom he or she has been appointed to act (known as 'P').

However incapacity is not a continuing state. This means that even in circumstances where the Court appoints a deputy, 'P' is not prevented from making decisions, where the deputy knows or reasonably believes 'P' has capacity in relation to that decision (Mental Capacity Act 2005, section 20(1)).

As such, the deputy should determine whether 'P' has sufficient capacity to decide if their will may be disclosed or whether they should rely on the Court order. It is too onerous to require a deputy to provide medical evidence of capacity on each and every decision he or she makes, including capacity to consent to disclosure of 'P's will, so the solicitor is able to rely on the deputy's request for disclosure.

Letter 2 at the end of this guidance is a template that can be used as a covering letter for sending the will to the deputy.

The duty to consult the client

Obtaining a copy of the will is a 'best interests' decision, and where it is reasonably practical to do so the attorney or deputy should involve the person they act for and let him or her know of any request that is made to see a copy.

Disclosure is a significant decision and a deputy would be expected to report this to the Office of the Public Guardian, when submitting his or her annual report.

Further help

If you require further assistance, please contact the Professional Ethics helpline.

Other resources

Open allRefusal Notice for disclosure of a will

Date:

Request by an attorney or deputy for a copy of the will of the person for whom they act

Your request for disclosure of the will of the person for whom you act under an Enduring or Lasting Power of attorney or Deputyship Order has been denied at this time.

To obtain a copy of the will you will need to apply to the Court of Protection for a specific court order.

Details of how to obtain an order, and relevant application forms, can be found here - www.gov.uk/courts-tribunals/court-of-protection

Dear [insert the name of the donor]

You may recall that you made an [Enduring/Lasting] Power of Attorney and appointed [insert the name of the attorney requesting the will] to act on your behalf in relation to your property and finances.

Your attorney has asked for a copy of your will [and codicil(s] which this firm holds for safekeeping. Your attorney is allowed to see your financial papers and documents, which includes a full copy of your will [and codicil(s)] unless you decide you would prefer for [him/her] not to see it. By knowing its content your attorney is in a better position to make decisions in your best interests, taking into account your wishes as set out in your will.

If you do not want us to let your attorney have a copy of your will [and codicil(s)], and if you would like to discuss this further please telephone me on [insert telephone number] by [inset a reasonable date that takes into account statutory and bank holidays ]. If I do not hear from you by that date I will let your attorney have a copy of your will.

Yours sincerely,

Dear [insert the name of the requesting attorney/deputy],

Re: [insert client's name]

As previously requested, I enclose a copy of [insert client's name] will [and codicil(s)]. The original remains within the firm for safe keeping.

As [an attorney][a deputy] when making financial decisions you are under a duty, so far as is reasonably possible, not to interfere with the succession plans made by [insert client's name]. You may wish to seek professional advice regarding this, particularly if you wish to sell or transfer assets, and make appropriate investments. There are occasions when a court order should be obtained to reflect [insert the client's name]'s intention and reduce financial loss to an eventual beneficiary.

Please let me know if I can assist further.

Yours sincerely,