Evaluating our reforms: Accountants' reports

Published: May 2018

Introduction and next steps

- 1.

This report:

- sets out the changes we have introduced so far to the accountant's report requirements

- evaluates the impact of these changes

- provides examples of reports submitted to us (see appendix 1): some that provide us with the information we need to decide whether to take a matter forward and some where we think improvements could be made. Please note these examples are not intended as best practice templates.

- 2.

Around 7,500 law firms hold client money and are therefore required to comply with our Accounts Rules. The purpose of these rules is simply to keep client money safe. One of the requirements is for firms to obtain an independent accountant’s report, which assesses the firm’s compliance with the rules. Where issues are identified, the report is qualified and submitted to us by the firm.

- 3.

Accountant’s reports are one way that we monitor compliance with our Accounts Rules and identify genuine risks to client money. These reports can be an important source of information for our wider regulatory work. The number of qualified reports has historically been quite high as reports were qualified whenever the accountant found a breach of the Accounts Rules. Between June 2012 to December 2013, more than 50 percent of all reports received were qualified. However, out of those reports, less than one percent were deemed serious enough for us to consider further investigation. This reflects the fact that the current Accounts Rules are very difficult to comply with due to their prescriptive nature.

- 4.

In November 2014 we changed the requirements so that only qualified reports must be sent to us. In November 2015 we introduced further changes, including a new format for the reports which focuses on identifying risks to client money rather than identifying specific, technical breaches of the Accounts Rules. This approach emphasised the importance of the accountant’s professional judgment. Our intention was to ensure our requirements were both proportionate and targeted. We also introduced an exemption for firms that hold low levels of client money from the requirement to obtain an accountant’s report.

- 5.

These changes are part of our regulatory reform programme. Through our reforms, we are seeking to introduce a more flexible, principles based approach to regulation. We have recently consulted on and published new Accounts Rules, alongside our response to consultation. The new rules are less detailed and prescriptive, with a sharp focus on the key risks to client money. So, this is an appropriate point to take a closer look at the reforms we have made so far and consider what impact they have had.

- 6.

The new Accounts Rules will be introduced alongside the rest of our Handbook reforms, no earlier than late 2018. As such this report does not consider the impact of the new Accounts Rules.

What did we change?

- 7.

We used to ask all firms that held client money to submit an accountant’s report to us every year, regardless of how much money the firm held or if the report was qualified or not.

- 8.

We introduced changes to our accountant’s report requirements in two phases.

- 9.

Phase one was implemented on 1 November 2014. Through it we:

- removed the need for firms to submit reports to us where there were no breaches of our Accounts Rules (unqualified reports)

- introduced an exemption from obtaining an accountant’s report for firms whose work is 100 percent funded by legal aid.

- 10.

Phase two was implemented on 1 November 2015. Through it we:

- asked reporting accountants to use their professional judgment when carrying out their work, to assess and identify risks to client money, and qualify when they judge that money has been placed at risk.

- introduced a new format for accountants’ reports (for the financial years ending after 1 November 2015). The new format report allows for more tailored reporting by the accountant, removing the tick-boxes that used to be on it.

- exempted firms that have an average client account balance of no more than £10,000 and a maximum balance of no more than £250,000 over the accounting period from the obligation to obtain an accountant’s report.

- 11.

These changes were designed to make our rules more proportionate and targeted, ensuring that we do not collect data we do not use or need to carry out our work. There is also a benefit to those firms that would be exempt from obtaining an accountant’s report, as they can be quite costly.

- 12.

One of our key changes was to rely more on the professional judgment of reporting accountants. Before these changes, reporting accountants had to complete the same checklist for every firm. This checklist meant that reports were qualified for any breach identified, regardless of the actual risk associated with that breach.

- 13.

The phase two changes allow reporting accountants to tailor their testing to the law firm and the work it conducts. We introduced the changes to the reporting requirements because we received many qualified accountant’s reports where no risks to client money had been identified and therefore no further action was needed.

- 14.

The primary focus of our changes was to make our reporting accountant’s regime more proportionate and flexible for firms. We did not think that the changes would have a direct impact on the overall cost of legal services for consumers. We said that the flexible structure we were allowing would provide more choice. This could lead to a greater variety of outcomes, including the cost of some services being affected, while others would not.

- 15.

The benefit to consumers of these reforms is in the wider impact that they have on the way legal services are delivered and regulated. These reforms reduce the regulatory burden on firms and, paired with our wider reform programme, can have benefits to the users of legal services by reducing the cost of legal services. There is also a consumer protection benefit as we now have more capacity to focus our time on investigating genuine risks to client money.

What does the data tell us?

- 16.

For the purposes of this report, we have looked more closely at three six-month periods and the number of reports we received in that time and what happened to them:

- 1 June–30 November 2015 (prior to the phase two changes)

- 1 June–30 November 2016 (after our changes)

- 1 June–30 November 2017

- 17.

The table below shows the number of reports we received and the actions we took.

Dates Number of qualified reports Considered for further investigation Investigated/under investigation 1 June – 30 Nov 2015 2,797 70 38 1 June – 30 Nov 2016 1,104 94 91 1 June – 30 Nov 2017 923 121 121 - 18.

We sometimes consider a qualified report in the context of an ongoing investigation into the firm for misconduct or breaches of our Accounts Rules. In these cases, a report can add value to our investigation by providing further detail and insight into how the firm is operating, and potentially point out issues we were not aware of. These reports are not included in the 'investigated/under investigation' numbers above.

- 19.

The findings from this evaluation indicate that there has been no adverse effect on consumers or consumer protection from our reforms to date.

Finding 1: We are receiving fewer reports

- 20.

This is due to:

- fewer firms having to produce reports

- fewer reports being qualified because of us asking reporting accountants to focus on risks to client money instead of technical breaches of the rules.

Finding 2: Feedback indicates that firms are engaging with their accountants over qualified reports

- 21.

Based on feedback from reporting accountants, we understand that firms now tend to take a qualified accountant’s report more seriously than before, as fewer reports are now qualified. We have been told that firms receiving a qualified report now increasingly want to improve their systems and controls, whereas previously this was not a common reaction.

Finding 3: We can focus our resources on identified risks

- 22.

The data also shows that we are acting in a slightly higher number of cases. This is positive as we can focus our resources on high-risk matters, rather than on processing a large volume of reports.

Finding 4: We are collecting less information that we do not use

- 23.

The overall proportion of cases that we take forward has increased. This is positive as it also shows that we are collecting less information that we do not actively use. The regulatory burden on firms has also been reduced, with fewer firms having to obtain reports in the first place. This is discussed below at paragraphs 38-44.

- 24.

As the table shows, we use just over one percent of all qualified reports received in 2015 (38 reports out of 2,797). This meant that we were receiving and reviewing many reports that did not show any substantial risks to client money

- however, if we compare this to 2016 (after the changes were introduced) we can see that of the 1,104 qualified reports received, 94 or 8.5 percent were considered for investigation

- we investigated 91, or 8.2 percent of all qualified reports received.

- for 2017, the proportion we investigated increased to 13.1 percent (121 of 923 reports).

Finding 5: We are taking action in a similar number of cases and there are no indicators that we are missing matters that lead to consumer detriment

- 25.

The numbers also suggest that the new format has increased the quality of the reports received, with a higher proportion of those we consider for investigation result in being investigated. We think this is positive, showing that the new format has been successful in helping us receive better, more relevant information. Fewer reports submitted to us means we can focus on identifying and progressing those reports that highlight significant risks to client money.

- 26.

The most common outcome where we do decide to investigate a qualified report is that we engage with the firm informally to resolve potential issues through advice and guidance. Usually, a matter is closed with no regulatory action taken.

- 27.

The number of cases where we have found sufficient evidence of wrongdoing to warrant regulatory action remain similar (four cases in 2015 and six in 2016). This is also the case for matters referred to the Solicitors Disciplinary Tribunal (two were referred in the 2015 period and four in the 2016 period). 1

Finding 6: We are still seeing reports being unnecessarily qualified

- 28.

The data shows there has been a significant percentage increase in the number of reports we consider for investigations. This is positive. However, we are still receiving large numbers of reports that do not require any further consideration or investigation by us.

Accountants’ reports in numbers

Qualified Accountants' reports received 2014-2017

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2014 | 157 | 170 | 282 | 188 | 180 | 438 | 209 | 261 | 1330 | 839 | 257 | 303 |

| 2015 | 149 | 133 | 261 | 164 | 162 | 360 | 177 | 213 | 1148 | 686 | 213 | 228 |

| 2016 | 135 | 123 | 237 | 142 | 80 | 177 | 57 | 81 | 465 | 225 | 99 | 94 |

| 2017 | 62 | 70 | 116 | 65 | 65 | 149 | 60 | 93 | 432 | 159 | 81 | 79 |

- 29.

The table above shows the number of qualified accountants’ reports we received each month in 2014–2017. We receive fewer reports now than previously. There is a clear spike in the number of reports we received in September and October each year. This is six months after April, the financial year end for most firms. This remains the case after the changes were introduced.

- 30.

We can see that the number of qualified reports has reduced year on year following the change. Around 19 percent of firms that hold client money in 2017 submitted qualified reports in 2017. This is a significant reduction from 2015, when 49 percent of firms had a qualified report, and 2016 when 25 percent did.

- 31.

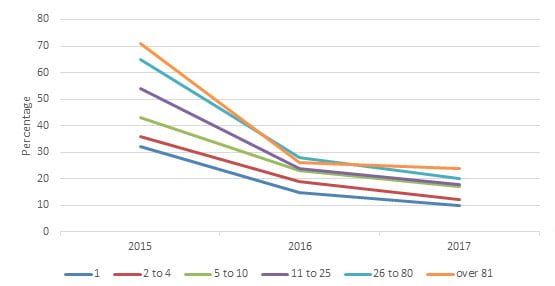

We have also taken a closer look at how this reduction has affected firms according to their size. The chart below shows the percentage of firms (divided by firm size, according to number of fee earners in the firm) that submitted a qualified report between 2015-2017.

Qualified reports by firm size and year

- 32.

The biggest reduction in qualified reports can be seen in firms with more than 81 fee earners. Of these, 71 percent of firms received a qualified report in 2015 with only 24 percent in 2017. However, there has been a reduction across all firm sizes. The proportion of firms with one fee earner who receive a qualified report is significantly lower than that for the larger firms. So, 24 percent of the largest firms received a qualified report in 2017 and 10 percent of the smallest firms.

- 33.

Both these graphs show a significant decrease in the number of qualified reports following our change to ask reporting accountants to rely on their professional judgment. This is positive and shows that our reforms are having their intended effect.

Equality and diversity

- 34.

When we introduced the exemption from obtaining an accountants report in 2014 we predicted that this would have a positive outcome for BAME partner majority firms. These firms are traditionally fall into the small firm category. We have looked closer at the data for these types of firms to see if this has proven to be the case.

- 35.

We collect diversity data for firms that we regulate every two years. We have looked at the ethnicity data for firms that received qualified reports in 2015 and in 2017. The data shows that there is a slightly lower BAME partner equivalent in firms who receive a qualified report.

2017 - firms that had a qualified report 2017 - all firms that hold client money BAME partner 10% 13% White partner 83% 79% Unknown 6% 8% Total 100% 100% - 36.

This is similar to the data from 2015 (see table below) which shows that eight percent of BAME partner equivalent firms submitted a qualified report. This is lower than the overall percentage of firms with BAME partner equivalents who hold client money (12 percent). The findings indicate that the reforms are beneficial to BAME firms, reducing their regulatory burden.

2015 – firms that had a qualified report 2015 - all firms that hold client money BAME partner 8% 12% White partner 84% 80% Unknown 9% 9% Total 100% 100%

The exemption from obtaining an accountant’s report

- 37.

We expected to see a decrease in the overall number of accountants’ reports we received following the changes we made. We estimated in 2015 that around one in eight, (13 percent), of the reports we received were from firms which would, in future, be exempt from obtaining an accountant’s report. This is because they did not hold enough client money.

- 38.

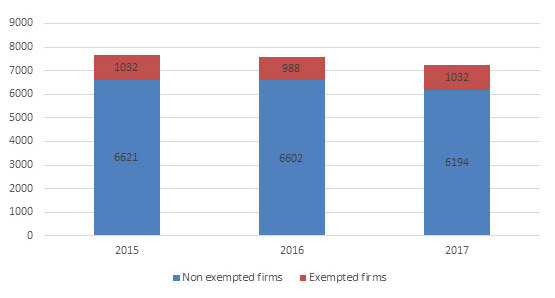

We have looked at the number of firms that are now exempt from obtaining an accountant’s report. As we mentioned in the introduction, around 7,500 firms hold client money. The table below shows the proportion of these firms that are exempt from obtaining a report.

Firms exempted from obtaining an Accountants Report

The figures for 2013 and 2014 are indicative of firms that would have been exempt from obtaining a report in these years, as the exemption was not introduced until 2015.

- 39.

These figures show that the number of firms that are exempt (or in the case of 2015 would have been exempt after the changes came in) has remained steady. Around 13 percent of all firms that hold client money are exempt from obtaining a report every year. This is consistent with our view when the changes were introduced.

- 40.

We have also looked at the equality and diversity data for firms that are exempt from obtaining an accountant’s report. Thirty percent of all partners (or equivalent) who work in exempted firms are of BAME background. This is higher than the 12 percent of all partner equivalents of BAME background who work at non-exempted firms.

- 41.

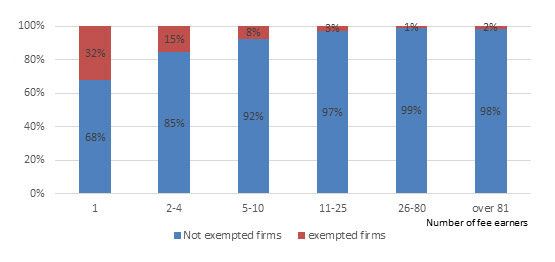

We have also looked at the size of firms (as measured by the total number of fee earners at a firm) that are exempt from obtaining an accountant’s report.

Firm size: exempted firms vs, non-exempted firms (2016)

- 42.

We can see from these figures that 32 percent of firms with one fee earner are exempt from obtaining a report. As we would expect, the number of firms that are exempt from obtaining a report decreases when the number of fee earners increases. Generally, larger firms will hold more client money. This means that they become less likely to fall under the exemption, which is based on the amount of money held in client account.

- 43.

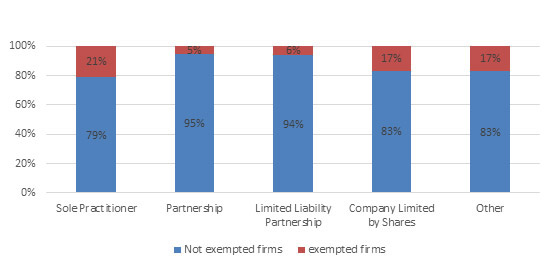

Finally, we have also looked at differences between firms based on their constitution. The table below shows that 21 percent of sole practitioners are exempt, but only 5-6 percent of partnership firms or limited liability partnerships.

Constitution type: exempted firms vs. non exempted firms (2016)

Conclusion

- 44.

Through the changes to our accountant’s reports requirements, we introduced a more proportionate and targeted regime for identifying firms that put client money at risk and do not have efficient systems and controls in place. Feedback we received before introducing the changes suggested that we were taking a risk in requiring firms to only submit qualified reports. Some respondents to the consultations felt that removing the obligation for all firms to submit an accountant’s report would lead to us not identifying and acting against firms that place client money at risk. Others were concerned that the change in approach and move away from assessment of technical compliance with the prescriptive rules would lead to reports not being qualified when they should have been. This could lead to unacceptable risks to consumers.

- 45.

The findings in this report show this concern has not materialised. Firms are still submitting their qualified reports to us, but we receive fewer of them and the ones we do receive are of greater value to us. This has reduced the administrative burden on both us and firms, which is a positive outcome. These reports mean that we are still finding similar levels of wrongdoing and evidence of inadequate systems where they exist.

- 46.

The incremental approach we have taken over the last few years means that we have a clearer understanding of where the real risks are and how best to manage them, moving from a burdensome and ineffective system to a much more targeted approach, making best use of lessons learned and accountants’ expertise and judgement. This evaluation supports the changes we have made, allowing us to focus regulatory resources and reducing unnecessary burdens on firms.

- 47.

Accountant’s reports form an important part of the work we do, but it is not the only way we receive information that leads to an investigation about the firms and solicitors we regulate. We also receive information from the public, whistle-blowers, other regulators and government bodies, to name a few.

- 48.

There has also been a positive impact for small firms and BAME majority firms, many of which have seen their regulatory burden reduced by removing them from the obligation to obtain an accountant’s report.

- 49.

There is, however, more that can be done to ensure that the benefits of the changes are realised. We are still receiving many reports unnecessarily. These come mainly from firms sending us their unqualified reports, but also from reports that are being qualified where no real risk to client money can be identified. We are working closely with the accountancy bodies to address these issues and provide guidance and information to accountants. Examples are included in appendix 1.

- 50.

When the new Accounts Rules come into force (not before late 2018), we think they will help reduce the instances where reports are qualified unnecessarily. The new rules are shorter and focused on the key principles for keeping client money safe. We have removed much of the prescriptive detail that is in the current rules that drives many of the qualified reports. We therefore consider the new rules will be helpful to both firms and to reporting accountants when performing their reviews as they are clearer on the standards we expect from firms.

What changes have we seen?

We review all qualified reports that are submitted to us. We have identified three common reasons for qualifying reports which seldom lead to further action. These are:

- where the firm has not moved balances quickly enough, but have identified the issue and have taken remedial action.

- where the firm has failed to transfer their costs from the client account within 14 days. There has been no indication that this was being done deliberately or for a more sinister reason.

- where the accountant lists several trivial breaches, which have been quickly identified and remedial action taken by the firm. These are instances where there has been no real risk to client money or assets identified, nor any systemic issues with the firm’s systems and controls.

This does not mean that we do not want to hear about these types of breaches. If the reporting accountant has seen one or more of the breaches above and thinks that this has put client money at risk, or that it shows a system failing with in the firm, this could be grounds for qualifying the report. It is up to the reporting accountant to use their professional judgment in these cases. It will however help our investigation if the relevant context is set out, to help us understand the risk better. For example, if the reporting accountant has been qualifying the report because of the same or similar breaches in previous years then it will help us if this is explained in the report.

We still receive many accountant’s reports. The standard of reports is generally high. However, there are some reports that could be improved.

A good report provides us with clear information on:

- the breach identified

- how many breaches that have occurred

- how much money is involved in each breach

- the duration of the breach

- what steps have been taken to remedy the breach and ensure it is not repeated

- what steps have been taken to identify its source

- the reporting accountant’s professional opinion whether the breach was significant.

This should enable us to decide whether to investigate further without having to contact the firm for further information.

Examples of good quality reports

The examples below have been taken from real life reports we have received. They have been anonymised.

Example 1: Good quality report

The client did not perform five weekly client bank reconciliations for the year ended on 30 November 2015. We performed the bank reconciliations as at 30 June 2015 and 30 November 2015 and noted the following:

- There were differences arising on the two testing dates that could not be identified. We are unable to confirm whether this has resulted in any loss to any client. The differences were £755.02 on 30 June 2015 and £1,407.27 on 30 November 2015.

- There were 12 client ledgers overdrawn totalling £1,925.23 as at 30 June 2015 (client ledger balances totaled £249,249.18).

- There were 9 client ledgers overdrawn totalling £1,140.18 as at 30 November 2015 (client ledger balances totaled £142,749.77).

- There was 1 ledger overdrawn amounting to £98.42 for 14 days from 1 December 2014 to 15 December 2014, which was rectified when further money was received from the client on 15 December 2014.

- Office account entries were not maintained to date, and no office account bank reconciliations were performed during the year.

- The practice is now employing a firm of accountants to bring the client account up to date and has performed 5 weekly bank reconciliations. The latest one produced was at 2 June 2016 showing no difference between client ledgers and the client account.

- The cashier is carrying out the office account posting and bank reconciliation to bring the books up to date, so we can conclude that the system is now in place.

This report is clear because:

- The reporting accountant has identified and quantified the differences at two different dates, as well as provided an indication of the scale of the overall figures involved.

- The accountant has explained the reasons for the differences, why they could not be quantified and why they were unsure whether there had been losses to any clients.

- There is quantification of the number of matters and the monetary value of the debit balances and a note that these issues had been addressed.

- Details have been provided of other breaches and the period they covered.

- There are details of remedial measures undertaken and the impact these measures have had. The latest client account reconciliation showed no differences between client ledgers and client bank account balances and office account postings are now being made.

This report could be improved by:

- Providing details of when the debit balances at each of the dates were rectified

- Explaining why there were no reconciliations performed for the year under review.

Example 2: Good quality report

- Breach of rule 29.12 – There are 6 instances where reconciliations were not carried out within 5 weeks of the previous one. 5 reconciliations were performed several months after the date to with they were reconciling (although they were performed in quick succession). The delay was due to a migration over to a new accounting system.

- Breach of rule 20.6 – During the above, 2 client accounts were overdrawn during the year due to duplicated payments to HMRC for stamp duty. In one instance an amount was withdrawn of £13,600 in September 2016 and in the other an amount was withdrawn for £21,200 in October 2016. These were identified by the client in January 2017 and letters were sent to HMRC on 19 and 30 January 2017 respectively, requesting a refund of these monies. These were refunded in March 2017 and the client ledgers are no longer overdrawn. The full impact has been explained by the firm to use and we are satisfied that no prejudice was caused to clients.

- Breach of rule 14.3 – There were a number of occasions where the residual balances were not being returned to the client promptly. These mostly relate to balances inherited when the firm took over another firm in 2010, because finding information for these clients in order to contact them has been difficult. Work is still being carried out in an effort to reduce these balances.

- Breach of rules 14.4 – The firm have not informed all clients in writing where balances are being held for greater than 12 months, and the reason for its retention. This again relates to the same clients as at point 4, and is being addressed.

- Breaches 29.18 – We were unable to confirm that copies of all paid cheques have been kept by the bank this year. The firm had requested copies from the bank at the time of the audit, but a response had not been received.

- The firm has self-reported to the SRA the breaches of rules 29.12 and 20.6.

This report is clear because:

- The reporting accountant has identified and quantified the relevant numbers for each identified breach.

- Where possible, they have provided explanations why the breaches occurred.

- They have included their opinion on whether the breach placed any client money or assets at risk.

- They explain what steps the firm has taken to remedy breaches.

- It shows that the firm has self-reported to us for breaches during the year.

- It informs us that the firm is taking actions to remedy on-going issues that are a result of the firm taking over another practice.

This report could be improved by:

- Providing a reference number to help us identify when the self-report was made.

Examples of reports where improvements could be made

Some of the reports submitted to us do not contain all the information we need to decide whether to investigate.

The following are all examples of accountant’s reports that should probably not have been qualified, although in most cases more information is required to be sure of this. The Reporting accountants should have included further information if a qualification was warranted, and where they have identified a risk to client funds.

Example 3: Report that could be improved

Breaches identified

Overdrawn Client Accounts

Numerous instances of overdrawn client accounts were identified during the year. We have examined the ledger on three separate dates and obtained explanations for each overdrawn account. We are satisfied that no loss has occurred to any client. The bookkeeper and COFA are aware of their existence and are actively working to clear them by prioritising by amount before proceeding with the transfers.

Suspense Ledger/Temporary Ledger

As noted in the previous accountant’s report it had been necessary to open a suspense ledger as a temporary measure when sorting out the problems which has arisen in the past. This suspense ledger was still in existence as at 31 July 2016. And had a balance on £1,800.65 at year end.

Credit Balances on Office Ledger

Numerous credit balances appeared on the office ledger as per the end of July 2016. This problem has also arisen in prior years and if occurs because of timing differences between bills being entered on the system and money being transferred from client to office accounts. The client is aware of the need to have a procedure in place to ensure that money cannot be transferred from client to office account before bills of costs have been entered on the system.

Bank Reconciliations

There were discrepancies between the office bank reconciliation and the ledger balance shown on the print provided to us for both dates (January and July 2016). When we questioned this, another print was provided with the correct ledger balance shown as at the 31 July 2016. This was also the case with the client account at the 31 July 2016. There were also discrepancies between the designated reconciliations as at 31 January and 31 July 2016 due to movements not being posted at all throughout the year.

Retained balances

After the completion of the client’s case the balances remaining on the client account were not always promptly paid to the client.

Current balance on client ledgers

Due to timing differences with posting some transactions, correct current balances were not always readily available during the year.

We think this report could be improved by:

- Providing details of how many instances they have identified of the respective breaches. The report mentions that numerous breaches have been identified, but does not mention specifics.

- Providing more detail of what steps (if any) the client is taking, or planning to take, to establish the procedures needed to pre-empt any future breaches.

- Providing us with details of the figures involved in the various breaches.

- Providing details of the duration of the breaches.

Example 4: Report that could be improved

There were several instances of client money not being returned to the client as soon as there is no longer any proper reason to retain those funds, and not informing the client in writing of the amount of any client money retained at the end of a matter, which is a breach of rule 14.3 and 14.4 respectively.

We think this report could be improved by:

- Providing more information, such as the number of occasions when the breach had occurred, and the amount of money involved in each event. This would help us determine the seriousness of the breach

- In addition to including the number of breaches, including the amounts of the residual balances, the report should state whether the firm is addressing the matter. If the firm is dealing with the breaches and the amounts are not material, then the report should not have been qualified.

- Note that the figure of referral to the SDT only involves cases referred as a result of the qualified accountant’s report, not cases where the report was considered in another matter that was referred to the SDT.